Roshan Digital Account – Frequently Asked Questions

What is Roshan Digital Account?

Who is eligible to open a Roshan Digital Account (RDA)?

What is the definition of a Non-Resident Person?

Can I open a Roshan Digital Account in any currency?

How can I open my account?

How long will it take for my account to open?

While opening an account, do I have to fill the application form in one session? Will my data be saved somewhere?

Where can I get help in case there is an issue while completing the application?

What documents are required from a customer in support of proof of profession and source of income/funds?

Is my data, information and the documents uploaded to apply for the Roshan Digital Account safe and secure?

I am an EU citizen; will my data and information be used in a safe and secure environment as envisaged under GDPR.

Is it possible to open more than one Roshan Digital Account?

What is the profit payment frequency for the Roshan Digital Account savings variant?

What if someone already has an account with MCB Bank? Can He / She open Roshan Digital Account as well?

Can anyone convert normal account to Roshan Digital Account?

How can I arrange funds in my Roshan Digital Acccount?

Is the RDA a restricted account? If yes, what types of transactions are allowed?

What type of taxes are applicable on my Roshan Digital Account?

What kind of investments can I opt for via the Roshan Digital Account?

Is compulsory deduction of Zakat, under Zakat & Ushr Ordinance 1980, applicable on RDA?

How can I invest in the Naya Pakistan Certificate (NPC)?

How can a customer purchase NPCs?

How can the purchase of NPC bond be funded?

What is the form, types and tenors of the NPC?

What is the profit payment frequency and is early encashment allowed?

What would happen in case of death of a customer/NPC holder?

What happens if there is any irregular activity / investment detected in the account or certificate?

Can the NPC be transferred or pledged?

Is the NPC subject to Zakat deduction?

How can I invest in Pakistan Stock Exchange?

Is the NPC subject to tax on profit payment?

If a customer already maintains an account with MCB, can the existing account be used for investing in NPCs?

How can I repatriate my funds?

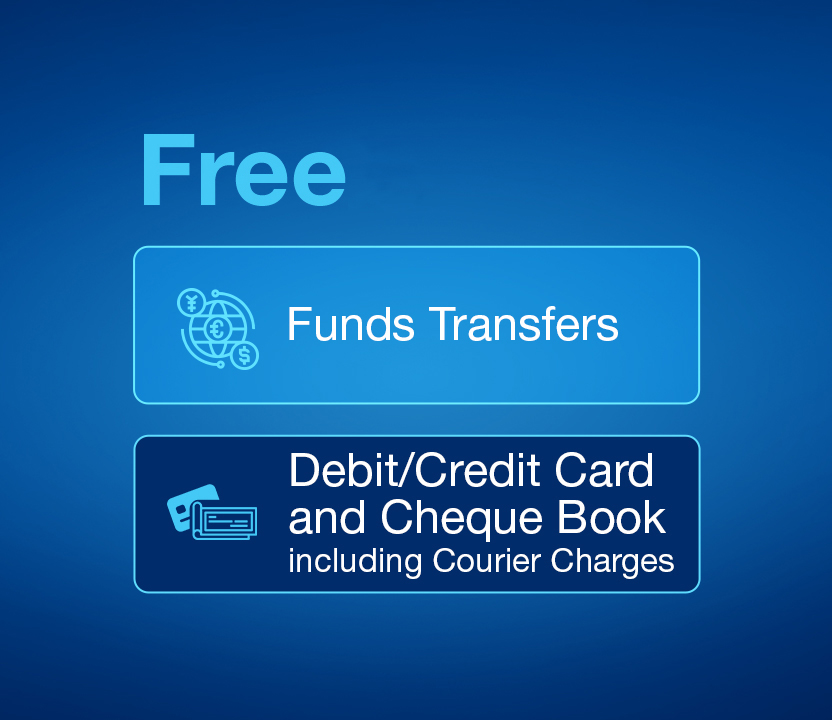

Can I apply for a Cheque Book and Debit card with my Roshan Digital Account?

How can I apply for a Cheque Book and Debit card?

How long will it take for me to receive my debit card and cheque book?

Which services can I apply for using my Roshan Digital Account?

Can I learn more on how to protect myself from digital frauds?

MCB Live - Frequently Asked Questions

What is MCB Live?

Why should I use MCB Live?

Who is eligible to use MCB Live?

I am an existing MCB Mobile user, how can I login MCB Live?

Can I login MCB Live using my old MCB Mobile credentials i.e. Registered Mobile number & Can I login MCB Live using my old MCB Mobile credentials i.e. Registered Mobile number & Can I login MCB Live using my old MCB Mobile credentials i.e. Registered Mo

What are the services offered by MCB Live?

I have MCB account, but no ATM/Debit Card. Can I still register to MCB Live?

How can I register on MCB Live?

If I am a Roshan Digital Account (Resident) user with no, inactive, temporarily or permanently blocked If I am a Roshan Digital Account (Resident) user with no, inactive, temporarily or permanently blocked Debit Card, will I be able to use MCB Live after

I am a Roshan Digital Account (Non-Resident) user; will I be able to use MCB Live after Registration?

I am a Non Resident MCB account holder; will I be able to use MCB Live after Registration?

How can I activate MCB Live?

What is OTP (One Time Password) and what it is used for?

Is there a mobile version of MCB Live?

Is there a web version of MCB Live?

Is MCB Live supported on all operating systems and phone sets?

What are the recommended browsers for accessing MCB Live?

I have multiple accounts with MCB Bank. How do I link them with MCB Live?

How to enable alternate login using Biometric/Face Login functionality on MCB Live app?

How to deactivate Biometric login functionality on MCB?

I have forgotten my Username. What should I do?

I want to retrieve my Username but do not have Debit Card?

I have forgotten my password. What should I do?

I want to reset my password but do not have Debit Card?

How can I change my MCB Live Password?

Are there any subscription charges for using MCB Live?

Are there any transactional charges?

Who can I pay using MCB Live Service?

How can I access ÂÂ"Add a new Payee"ÂÂ option?

How to add Payee for Funds Transfer within MCB Bank Steps to Add New Payee within MCB:

How to Add New Payee for IBFT using account number? Steps to Add New Payee for IBFT using account number:

How to add Payee for IBFT using IBAN Number?

What does MFB & EMI stand for?

Unable to perform IBFT after adding beneficiaries of MFBs & EMIs?

Unable to perform transaction after registering with a MCB Debit Card?

Unable to perform IBFT using Quick Transfer Option?

Unable to transfer to MFBs & EMIs?

Which companies in Pakistan are MFBs & EMIs?

How can I access "ÂÂAdd a new Biller"ÂÂ option?

How can I add a new Biller? Steps to "ÂÂAdd a new Biller"ÂÂ:

Adding Payee/Biller is necessary for transferring funds or paying bills?

What is meant by Quick Transfer & Quick Pay?

How can I access the Quick Transfer option on MCB Live?

How can I perform Quick Transfer?

How can I access the Quick Bill Pay option on MCB Live?

How can I perform Quick Bill Pay?

Will my Funds be transferred instantaneously?

Will my bills be paid instantaneously?

What is the difference between Mini Statement and Full Account Statement?

How to view my daily transaction limit and how can I change my allowed limits?

How to mark any transaction as favorite?

Can I temporarily block my MCB Live service?

How can I unblock my "MCB Live"ÂÂ account?

Can I pay other bank's credit card bills through MCB Live?

What is the advantage of assigning a nickname to an account?

How can I activate my MCB Debit Card?

Can I use any characters (a, 1,*3) to generate my Debit Card PIN?

How can I manage my Debit Card via MCB Live?

How can I change my MCB Debit Card PIN?

What to do if my Debit Card PIN is not working?

Can I activate my permanently blocked card?

Do I need to activate my online session before shopping online?

How can I temporarily block my Debit Card via MCB Live?

How can I unblock my temporarily blocked Debit Card via MCB Live?

How can I activate my E-commerce Session on Debit Card via MCB Live?

How can I enable International Usage on Debit Card via MCB Live?

How can I de-activate my International Usage Session on Debit Card via MCB Live?

Can I apply for a new cheque book via MCB Live?

How can I apply for a new Cheque book via MCB Live?

Can I stop mark my cheque via MCB Live?

How can I mark the Cheque stop?

Can I perform cheque status inquiry via MCB Live?

What is Manage Credit Card in MCB Live?

Can I change my Credit Card PIN via MCB Live?

I forgot my existing Credit card PIN code, could I generate new one with MCB Live?

Can I apply for Supplementary Card via MCB Live?

Can I lodge a complaint via MCB Live?

Can I download Withholding Tax certificate via MCB Live?

How can I deposit funds in my MCB Roshan Digital?

Can I invest in Naya Pakistan Certificates (NPC)?

In which currency I can purchase NayaPakistan Certificate?

If a customer already maintains an account with MCB, can the existing account be used for investing in NPCs?

How can I invest in Naya Pakistan Certificates (NPC) using MCB Live?

What is the form, types and tenors of the NPC (Naya Pakistan Certificate)?

How can I encash my investments?

How can I repatriate my funds?

How can I open CDC (Central Depository Company) Account (Roshan Equity Investment)?

How can I perform payment to CDC (Central Depository Company)?

How can I manage my MCB Credit Card in MCB LIVE?

What features are currently available of Credit Card in MCB LIVE?

Can I activate my MCB Credit Card?

Can I use any characters (a, 1,*) to generate my PIN?

Can I change my MCB Credit Card PIN?

What can I do if my PIN is not working?

What is temporary blocking of a Credit Card?

Can I Temporary Block and Unblock my Credit Card via MCB LIVE?

What is Card Blocking?

Can I activate a permanently blocked card?

Can I request a replacement Credit Card via MCB Live?

Can I apply for new Credit Card via MCB Live?

Can I apply for Supplementary Card via MCB Live?

Can I protect my Credit Card against misuse?

Can I activate/de-activate my Credit Card for use via different channels?

Can I pay my Utility Bills Mobile Postpaid, Mobile Top up & Govt. Payments?

How can I register my Credit Card via MCB Live?

How can I pay my Credit Card bill via MCB Live?

Can I pay my Credit Card bill more than my outstanding balance?

How can I subscribe for E-Statement facility?

How can I view and download my Credit Card statement?

Can I pay other bank's Credit Card bills through MCB Live via MCB Visa Credit Card?

MCB Mobile for Roshan Digital Account Users - Frequently Asked Questions

What is MCB Mobile?

Why should I use MCB Mobile?

Who is eligible to open a Roshan Digital Account (RDA)?

Is the RDA a restricted account? If yes, what types of transactions are allowed?

Is there a Mobile Application for Roshan Digital Account Users?

What is 'PIN'?

How do I change my account Login PIN?

What is 'OTP' and what is it used for?

What services can I avail on the MCB Mobile Web Portal?

Are there any transaction limits on Funds transfers and Bill Payments?

How can I invest in Naya Pakistan Certificates (NPC)?

If a customer already maintains an account with MCB, can the existing account be used for investing in NPCs?

How can I invest in Naya Pakistan Certificates (NPC) from MCB Mobile Portal?

What is the form, types and tenors of the NPC?

How can I redeem my investments?

How can I repatriate my funds?

How do I add a beneficiary?

How do I delete a beneficiary?

Can I pay MCB Bank and other Bank Credit Card bills using through MCB Mobile Web Portal?

At the time of performing any financial or non-financial transaction, the error 'Host not responding' is being displayed?

What should I do if I have a query which is not answered here?

How can I temporarily block my MCB Mobile service?

How can I re-activate my MCB Mobile service if it is temporarily blocked?

Can I share my Account/Card Details, PIN/Password through email, SMS or a phone call?

Does MCB Bank ever call its customers from +92 42 111-000-622?

What is BE AWARE, STAY SAFE?

Can I learn more on how to protect myself from digital frauds?